Looking for the best small business accounting software to manage your accounting with ease? Here are the 11 best accounting software for small businesses.

Running a small business is hard enough to begin with, but if you’re not the best at math and accounting, managing the finances of your business becomes even harder.

There are countless small business accounting software and services on the market to help you run your business effectively and manage your small business’s accounts. In this article, we’ll take a look at some of the best accounting software for small businesses.

Bookkeeping isn’t fun for most of us, but it’s an essential part of any business.

Traditional bookkeeping methods quickly become obsolete, and manual bookkeeping is almost dead. This change has led to a more robust and healthier suite of premium free small business accounting software.

These accounting programs and invoicing software come in all shapes and forms, and most of them have evolved into a full-fledged customer relationship management platform rather than just financial management software or bookkeeping software.

What are the commonly used accounting software for small businesses? Let us help you determine which free accounting software is best for small businesses and which paid options you should consider.

11 Popular Small Business Accounting Software Collection

There are a few key features to keep in mind when choosing the best accounting software for your small business, which are:

- Easy to use and user-friendly

- Integrate with other platforms and solutions

- Security and privacy

- price

- Mobility of cloud accessibility and platform usage.

With all these important key points in mind, let’s take a look at the list of small business accounting software. Here we go:

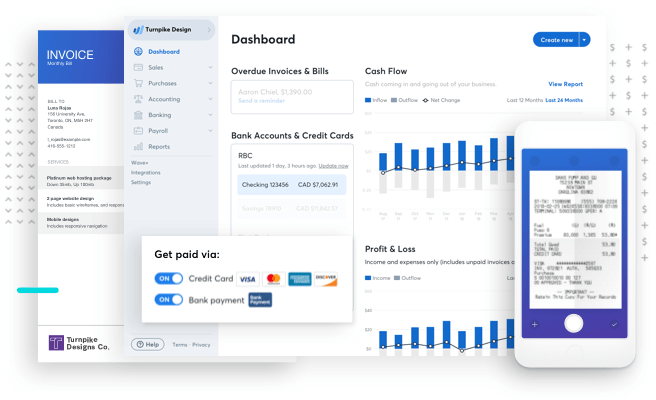

Wave Financial: Financial software for small businesses

Best Small Business Accounting Software Recommendation: Designed for small businesses with fewer than 10 employees, Wave Financial has gained a niche following among startups and new business communities. The Wave Financial software is an easy-to-use tool that allows users with no accounting knowledge at all to manage their books with ease.

Wave Financial can connect directly to your bank account and extract the necessary data when needed. It supports over 10,000 banks, and there’s absolutely no limit to the number of banks and cards you can link.

This free invoicing and accounting software allows you to manage accounts receivable, issue invoices and mark them as paid, send estimates to customers, manually pay vendors and vendors, and even pay your employees using built-in payroll features (available only in Canada and currently in the US).

For top management, it also provides a bird’s-eye view of the overall financial report, with the help of charts and charts to easily understand the financial situation.

While most features are free to use, features like payroll are billed at $4 per employee and $35 for the base fee. Bank payment and credit card processing fees are set at 1% and 2.9% + 30 cents per transaction, respectively

| Pros: | Cons: |

| Free to use, powerful reports are designed for small businesses | Automatic payments are not processed |

FreshBooks: Invoicing and accounting software for small businesses

Best Small Business Accounting Software Download: Rejoice for Solopreneurs & Freelancers! FreshBooks is a simple accounting software for small businesses and digital nomads across the globe. FreshBooks allows you to easily bill customers, track time spent on projects, invoice based on the number of hours recorded, and more.

FreshBooks accounting software has a set of templates for everyone. You can customize the invoice template to your liking and send it to your customers, and thanks to the ability to connect your bank account and your card, you can get paid instantly. Currently, FreshBooks doesn’t have features like payroll or powerful reporting, but the features it offers are more than enough for Solopreneur.

| Pros: | Cons: |

| Developed for freelancers and digital nomads with flexible invoicing, direct collection | There is no free product for limited financial reporting |

FreeAgent: Easy-to-use accounting software for small businesses

Whether you’re a freelancer, a small business owner, or their accountant, if you want to take control of your small business accounting, then FreeAgent’s online accounting software is one of the best solutions for you.

FreeAgent is a feature-rich, cloud-based accounting software designed to help freelancers, micro-businesses, and their accountants. It was named the number one accounting software in the UK in 2018.

This financial management software has almost all the features you need to keep your growing business finances on the right track, such as payroll, tax returns, expenses, estimates and invoices, bank transactions, monitoring cash flow, time tracking, and financial performance of projects.

What are the commonly used accounting software for small businesses? FreeAgent’s dashboard brings everything together in one place. You can see cash flow at a glance, view invoice schedules, real-time profit and loss status, and much more.

The ability to handle simple expense tracking, send professional estimates in minutes, multi-currency and multi-language invoices, better project visibility and clear project profitability, tracking billable and non-billable hours on desktop or mobile devices, automated bank feeds, and creating configurable sales tax reports make this online accounting software for small businesses even more powerful.

FreeAgent comes with a 30-day free trial plan that lets you try out all the main features. For the universal plan, you’ll have to pay $10 per month for the first 6 months and then $20 per month.

| Pros: | Cons: |

| Automatic invoicing and account overview with the ability to shoot receipts for super responsive customer support | More expensive than the competition, an old-fashioned UI for viewing recent spending |

QuickBooks – Online accounting software for small businesses

Best Accounting Software for Small Business Recommendation: This is another popular accounting solution and one of the best accounting solutions for small businesses. QuickBooks is an easy-to-use (no knowledge of finance or accounting required) cloud accounting software for small businesses that helps you fill out GST, prepare from scratch, and more.

QuickBooks’ user-friendly interface makes it easy to access all the features and functionality. This small business financial management software is priced at $10 per month, $17 per month, and $30 per month.

You can use QuickBooks to generate payroll for your employees. You can also use Quickbooks’ mobile app, which lets you manage all your taxes on the go.

QuickBooks is cloud-based (it’s a cloud accounting software) that ensures you get the best experience without worrying about system resources, crashes. There is no need for any antivirus software on the system to ensure that the software is working properly. You have a high degree of control over your data, ensuring that all the data you store on this software will never be compromised.

| Pros: | Cons: |

| Flexible third-party applications for easy access to excellent accounting reports | Lack of direct professional support, no option to customize the app, and a limit on the number of users |

GnuCash: Free accounting software

Popular Small Business Accounting Software Collection: As a small business owner, you may be reluctant to share your financial details with 3rd party organizations, so many small businesses still use spreadsheets to keep things at home. In this case, you can consider free and open-source accounting software such as GnuCash.

GnuCash free accounting software allows you to create custom reports by adapting the source code, and you can also run cash flow statements, create invoices, assign customers, and track accounts receivable. GnuCash doesn’t allow you to connect to a bank account, so this is a drawback, but it allows you to export reports in a standard format you may prefer.

| Pros: | Cons: |

| Open source can work offline | You can’t add a bank account for a single user only |

Zoho Books – Online accounting software for business growth

Best Small Business Accounting Software Download: If you’re looking for an easy-to-use accounting software designed for small businesses that allows you to easily send invoices, reconcile bank transactions, track inventory, generate reports, and submit GST returns, then you should use Zoho Books online accounting solution.

Zoho Books Software is an online accounting software that helps you manage your accounting, inventory, and filing GST returns with ease.

Priced at $9 per organization/month, the software provides you with features like a mobile app, accounting, and more, and since the software is cloud-based, you don’t have to worry about system limitations.

This GST-compliant software has many advantages, one of which is that you don’t need to worry about the resource consumption of your system. Since Zoho books is a cloud-based software, all the data in this online accounting software will remain safe even if your system fails. Users also get the option to customize Zoho Books according to their needs.

While there are many benefits to this software, one thing we don’t like is that it requires an active internet connection to get full functionality. In addition, you can use up to 10 users on one account in Zoho Books.

| Pros: | Cons: |

| The automated bank feed offers a free trial with excellent customer engagement | The number of users is limited and sometimes the working hours are too long |

ZipBooks: Free accounting software and online invoicing

If you’re starting out with spreadsheets to bookkeep your business and want something better, but maybe not as feature-rich as other platforms, then ZipBooks is the solution for you.

Built for freelancers and micro-business owners, ZipBooks makes it easy to invoice and report for more efficient management of your business. You can connect bank accounts and manage your entire business directly from Zipbook.

It is a free accounting software for small businesses that provides you with basic features. Premium feature-rich plans start at just $15 per month. If you want, you can also get a personal bookkeeper by getting a top-tier service plan.

| Pros: | Cons: |

| The freemium model tracks time, accounts receivable, and accounts payable connected to bank account visualization reports | Premium features aren’t free, and they cost quite a bit of money |

SlickPie: Free accounting software for small businesses

Best Accounting Software for Small Business Recommendation: The ease of use claimed by SlickPie free accounting software is pleasing, and I don’t disagree. A great user interface and features, such as powerful financial reporting when connecting bank accounts and cards, easy invoicing and tracking of accounts receivable, and manual processing of accounts payable, are what make SlickPie a comprehensive accounting software for small businesses.

You can receive payments online directly in your bank account with the help of SlickPie, with unlimited accounts linked to your SlickPie account. You can also track unlimited projects and send as many invoices as you want.

| Pros: | Cons: |

| Easy to use, no limitations, cross-platform support | The cash flow statement is not shown, and the reporting ability is relatively weak |

GoDaddy Bookkeeping: Online Bookkeeping Software

Popular Small Business Accounting Software Collection: If you run an online business, you’re probably already familiar with GoDaddy (the world’s largest domain name registrar), domain names, hosting, and various other service providers related to internet business. GoDaddy Bookkeeping connects to all of your ecommerce platforms, such as Amazon, Etsy, and eBay, allowing you to view visual reports for business intelligence.

GoDaddy Online Bookkeeping lets you create invoices, process invoices, and calculate taxes from the comfort of your own home. The platform is very restrictive and is mainly suitable for independent entrepreneurs who primarily sell on supported e-commerce platforms to make a living. This platform is best suited for people from the United States.

| Pros: | Cons: |

| Reputable for cross-platform compatibility to help you prepare for your taxes | Limited to one program with a paid primary suitability for U.S. residents |

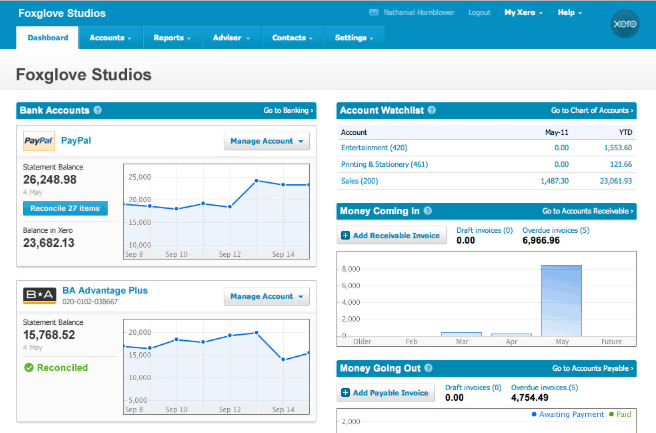

Xero: Online accounting software for your small business

Best Small Business Accounting Software Download: Xero is a more professional accounting software for small businesses, and while it is easy to use, it is not the easiest and requires some prior knowledge of accounting work.

If you wish, you can assign a dedicated bookkeeper to handle your accounting duties. Features such as quotes, invoicing, and multi-currency transactions are also available in Xero’s online accounting software, but they are quite expensive to use.

Overall, this small business accounting software is very expensive, with the basic package costing $25 per month.

| Pros: | Cons: |

| Professional-grade features: inventory management, overall financial reporting | Expensive is not very easy to use and intuitive |

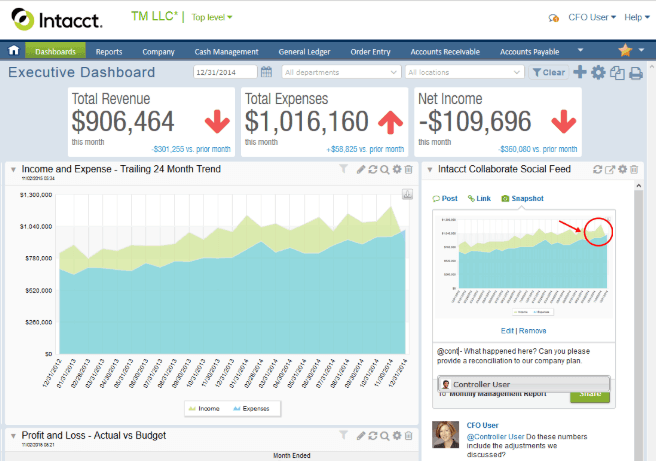

Sage Intacct: Cloud financial management software

What are the commonly used accounting software for small businesses? If you need an all-encompassing cloud accounting software to grow your small business, then Sage Intacct should be the ideal choice for you. Sage Intacct is a widely used accounting software for small businesses and a top choice for the AICPA.

It is a full-fledged financial management software that handles purchases, subscriptions, billing, petty cash management, and reconciliation and consolidation. It can do all the things that a CPA or CA would do. The software is designed to improve overall business efficiency and minimize losses, if any.

Sage Intacct is also one of the most versatile if it’s one of the most expensive online accounting software for small businesses.

| Pros: | Cons: |

| Versatile to help with excellent reporting for business accounting | Difficult to use requires some understanding of accounting and finance |

Conclusion

So, here is a list of accounting software for growing businesses (small and medium-sized businesses). We hope we’ve been able to help you find the best accounting software for small businesses that you can use to manage your business finances with ease.

If you have any questions or comments about these small business accounting software and online financial management services, let us know in the comments and we’ll do our best to help you.